Bitcoin has experienced a steep decline, dropping approximately 7% from its recent peak of $123,000, and is now testing a crucial support level around $114,650. This downturn comes amid a broader market sell-off and notable outflows from cryptocurrency exchange-traded funds (ETFs). The situation reflects shifting investor sentiment as capital flows towards alternative cryptocurrencies, particularly Ethereum, which has surged by 55% this month.

Market Dynamics and Whale Activity

A significant factor contributing to Bitcoin’s current challenges is the outflow from “whale” wallets, which are defined as those holding between 1,000 to 10,000 BTC. Over the past ten days, the number of these wallets has decreased by 2.7%, marking the largest decline seen in six months. This trend raises concerns, particularly as some of the sales have been attributed to older wallets from the early days of Bitcoin, often referred to as the “Satoshi era.”

Adding to the market unease is the recent transfer of 10,000 BTC, valued at approximately $1.18 billion, by Galaxy Digital to an exchange. This move has further unsettled investors. Institutional selling has also exerted downward pressure on prices, with Bitcoin ETFs witnessing outflows totaling $285 million over the last three days. While some of these outflows may represent profit-taking following recent gains, the inability of Bitcoin to maintain momentum towards the $120,000 mark has amplified concerns regarding increasing selling pressure.

The movement of capital into altcoins has also played a pivotal role in Bitcoin’s recent performance. Money has shifted from Bitcoin to Ethereum, which has gained significant traction due to rising interest in spot ETF activity. This shift has diverted trading volume and attention away from Bitcoin, contributing to its stagnation.

Global Economic Factors and Technical Outlook

Recent global economic developments are adding indirect pressure to the cryptocurrency market. As the August 1 deadline for U.S. tariffs approaches, many investors are adopting a more cautious stance. The prevailing uncertainty has prompted some to take profits from recent cryptocurrency gains and redirect funds into safer assets. Consequently, the rate of outflows from the crypto market has intensified in the latter half of the week.

Next week will be critical for investors, particularly with a packed macroeconomic calendar in the U.S. Key data on employment and growth, along with the Federal Reserve’s interest rate decision, will be closely monitored. These events, coinciding with the approaching tariff deadline, are likely to induce volatility in the market.

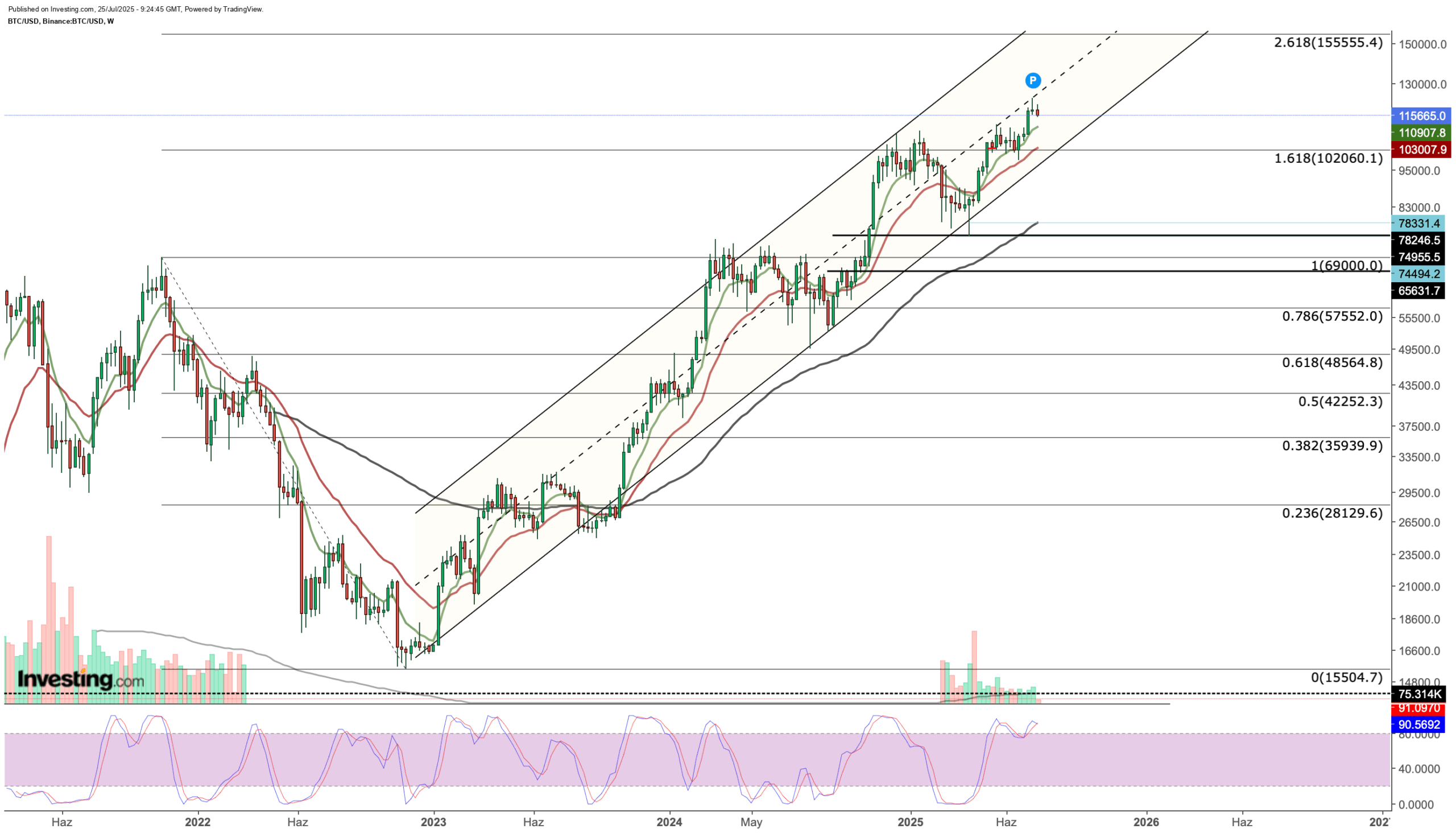

Currently, Bitcoin’s downtrend has not yet undermined its broader upward trajectory. Nevertheless, it is essential to monitor key short-term support levels closely. If Bitcoin fails to maintain these levels, a more significant sell-off could be triggered, leading to a deeper correction. Presently, Bitcoin faces resistance at the mid-band of its ascending channel on the weekly chart, with critical support around $110,800. A breach of this level could prompt a price retreat towards $102,000, which aligns with the lower band of the channel.

Despite the volatility, as long as Bitcoin remains above $102,000, any deeper corrections could potentially reinforce the long-term upward trend. Conversely, if the $102,000 support is broken, it could indicate a trend reversal and open the door for a broader correction towards the $70,000 range.

On the daily chart, Bitcoin has reached a crucial short-term support area following the recent decline. This support is defined by the 1.272 Fibonacci expansion level and the short-term exponential moving average (EMA). If Bitcoin stays above $114,600, the recent pullback may be viewed as a limited correction. Resistance at the 1.414 Fibonacci level—approximately $119,000—will be key. Should Bitcoin surpass this level, a more robust recovery could follow, potentially leading to a new peak near $125,400.

In contrast, if Bitcoin closes below the $114,600 support, it may signal a pullback towards the $106,000 to $110,000 range. This zone aligns with significant weekly support and is therefore critical for traders to observe.

As the market moves forward, Bitcoin and the broader cryptocurrency landscape are likely to be increasingly sensitive to macroeconomic developments. Investors are advised to proceed with caution, given the current volatility and shifting market dynamics.