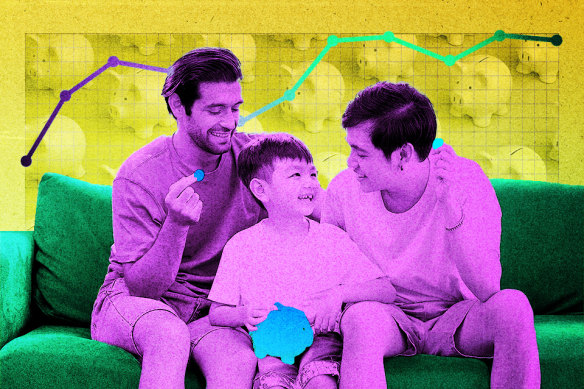

A recent conversation between a parent and their teenage son has highlighted significant gaps in financial education within Australian schools. The 15-year-old revealed that during his decade of schooling, he had participated in only one financial exercise: setting up a food stall, managing purchases, selling food, and calculating profits. This revelation raises concerns about the effectiveness of financial literacy education in a country where such knowledge is increasingly vital.

The Australian Government Financial Literacy Board was established over a decade ago to embed money management skills in the national curriculum. Despite these efforts, statistics indicate that young Australians are struggling with financial independence. According to the Household, Income and Labour Dynamics in Australia (HILDA) survey, over half of young men (54 percent) and nearly half of young women (47 percent) aged 18 to 29 still live with their parents. This trend reflects broader economic challenges, including a declining rate of home ownership among young Australians, which has been falling since the 1980s.

Research from the University of New South Wales shows that the average age of first-time homebuyers has risen to 36 years. This increase is a stark contrast to previous generations, where home ownership was often achieved in the early 30s or even late 20s. The situation underscores the necessity for enhanced financial education earlier in life.

In addition, the report from HILDA indicates a shift in the workforce participation of older Australians. Those aged 60 to 69 are working longer than they did two decades ago, reflecting both economic pressures and changing retirement norms. A growing trend is the reliance on the so-called “bank of mum and dad,” which has become one of the largest financial institutions in Australia. Parents are increasingly stepping in to support their children financially, further emphasizing the need for young people to develop their own financial skills.

Recognizing the critical importance of financial literacy, New Zealand is set to implement mandatory financial education in schools starting in 2024. The initiative will be integrated into the social sciences curriculum for students from year one through to year ten. This proactive approach aims to equip young New Zealanders with essential money management skills, a move that could serve as a model for Australian educational policy.

As discussions on financial literacy continue, the responsibility increasingly falls to parents to supplement their children’s education. The need for comprehensive financial education is clear, as young Australians face a complex economic landscape. Developing strong financial skills can empower future generations to navigate these challenges effectively and foster independence. The conversation about money should not only occur at home but also be an integral part of the school curriculum, preparing students for the realities of adult life.