The Federal Treasury is contemplating a significant shift in the open banking framework, proposing to exempt small lenders from the Consumer Data Right (CDR) regime. This potential change has drawn concerns from mortgage brokers who argue it could hinder consumers’ ability to compare financial products effectively.

According to a consultation document obtained by The Australian Financial Review, the proposal would allow 55 small banks with less than $5 billion in loans to opt out of the data-sharing system. If implemented, this would prevent customers of these banks from sharing their financial data through the regulated open banking system, impacting their ability to secure better deals on products such as mortgages, savings accounts, and term deposits.

The open banking initiative, which began in July 2020 under the Morrison government, aims to enhance competition by allowing consumers to safely share their banking data with other lenders and fintech companies. Banks have invested over $1.5 billion in developing this system, which replaces the less secure practice known as screen scraping. This method involved sharing banking passwords, introducing potential cybersecurity risks for consumers.

The consultation document suggests that if the exemption goes through, the obligations to share data would be lifted for 55 banks, leaving only 22 banks, including major regional institutions, within the regulated framework overseen by the Australian Competition and Consumer Commission (ACCC).

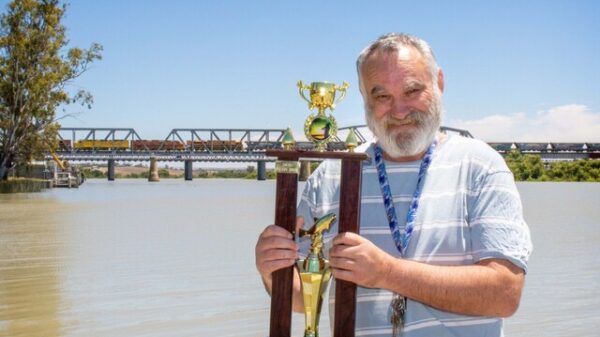

Stuart Low, chief executive of Biza, a company that facilitates data sharing for small banks, expressed strong reservations about the proposal. He stated, “This is not a consumer ecosystem if two-thirds of banks are not in it.” Low highlighted that losing a quarter of the smaller banks as clients could force Biza to exit the banking market entirely, shifting its focus to data sharing in energy and non-bank lending sectors.

Concerns about the proposal extend to the mortgage brokerage community. The Mortgage and Finance Association of Australia (MFAA) has voiced its opposition. CEO Anja Pannek stressed that the continued expansion of open banking is crucial for all lenders and non-banks, arguing, “Carving out dozens of smaller banks risks a two-speed regime.” She noted that recent innovations have allowed brokers access to open banking tools that enable clients to share and verify their financial information efficiently.

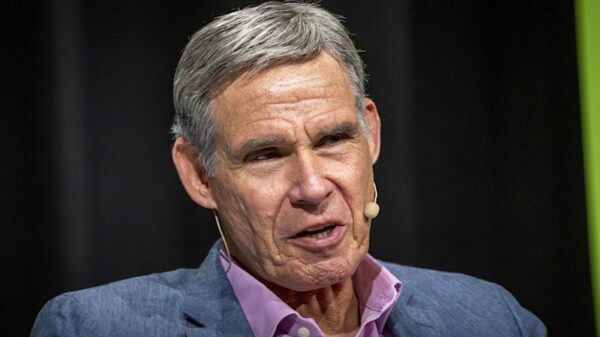

The Customer Owned Banking Association (COBA) has consistently raised concerns regarding the high compliance costs associated with the CDR. COBA has reported that customer-owned banks have collectively spent over $100 million on the initiative, with minimal benefits thus far. Simon Birmingham, chief executive of the Australian Banking Association, acknowledged the high compliance costs but expressed belief in the regime’s long-term viability, stating, “CDR has imposed high compliance costs on all participants and is fertile ground to make a big contribution to the government’s regulatory simplification agenda.”

The Albanese government is currently engaged in a “reset” of the CDR, aiming to identify ways to reduce compliance costs and enhance consumer uptake. A spokeswoman for Assistant Treasurer Daniel Mulino confirmed that targeted consultations are underway, with public feedback expected to inform future steps.

In recent months, the take-up of open banking has shown promising growth. The ACCC reported that more than 800,000 consumers had utilized the CDR between January and July this year, marking a 50 percent increase compared to the previous six-month period. Additionally, the ACCC indicated that there had been 582 million data requests in the six months leading to December, with an annualized rate exceeding 1 billion requests.

As discussions progress, the future of open banking and its impact on consumer choices in Australia remains a critical issue for stakeholders across the financial services landscape. The outcomes of the Treasury’s consultations could reshape the competitive dynamics of the sector, potentially affecting millions of consumers reliant on transparent and accessible banking practices.