Global stocks began the week on a positive trajectory as investors responded to increasing expectations of a Federal Reserve interest rate cut in December. This sentiment came despite ongoing divisions among policymakers regarding the timing and necessity of such a move.

As the week unfolds, market participants are keenly awaiting significant economic indicators, including US retail sales and producer prices data set for release later this week. Additionally, British finance minister Rachel Reeves is expected to present her much-anticipated budget on Wednesday, which could further influence market dynamics.

Geopolitical developments are also under scrutiny. The United States and Ukraine are continuing efforts to formulate a new plan to conclude the ongoing conflict with Russia. This follows modifications to an earlier proposal that had been criticized by Kyiv and its European allies for being overly favorable to Moscow. Such diplomatic efforts have impacted oil prices, as a potential agreement might allow for an increase in Russian supply through eased sanctions.

In Europe, stocks surged during early trading, recovering from a recent downturn attributed to concerns over inflated technology valuations. The STOXX 600, which had closed the previous week down by 2.2 percent, rose by 0.5 percent on Monday. While shares in defense companies experienced a decline, gains in technology, pharmaceuticals, and banking sectors offset these losses. In the United States, futures for the Nasdaq and S&P 500 climbed by 0.8 percent and 0.55 percent, respectively, while the MSCI index of Asia-Pacific shares outside Japan gained 1 percent overnight.

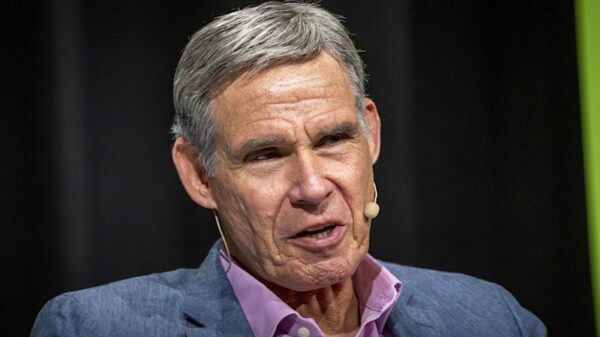

The recent market uptick follows comments from influential Federal Reserve policymaker John Williams, who suggested on Friday that interest rates might decrease “in the near term.” Goldman Sachs chief economist Jan Hatzius noted in a report that he anticipates another rate cut in December, along with two additional reductions in March and June 2026, lowering the funds rate to a range of 3-3.25 percent.

Currently, futures linked to the Fed funds rate indicate approximately a 60 percent likelihood of a 25 basis points cut next month. However, the recent US government shutdown, which concluded earlier this month, has complicated the outlook for US rates. The US Bureau of Labor Statistics announced on Friday that it would not release the October consumer price report due to data collection interruptions caused by the shutdown.

In light of the current economic situation, Paolo Zanghieri, senior economist at Generali Investments, expressed skepticism regarding the market’s expectations of aggressive rate cuts. He assessed the chance of a cut next month at “50/50” and suggested that the Fed might choose to wait until January to make a decision, while signaling a bias towards easing. Zanghieri also cautioned that the market’s optimism for nearly four cuts next year may be misplaced, predicting only 50 basis points of easing by summer.

In the currency markets, the focus centered on the Japanese yen, which was trading near a ten-month low as the dollar increased by 0.3 percent to 156.86 yen. The yen has depreciated approximately 1.8 percent in value so far this month, making it the weakest major currency against the dollar. Traders remain vigilant for potential intervention from Japanese authorities to stabilize the currency, which has faced pressure from concerns regarding Japan’s fiscal health and persistently low domestic interest rates. Finance Minister Satsuki Katayama intensified her verbal efforts to support the yen last week, which appears to have temporarily halted its decline.

Despite the dollar’s strength against the yen, it weakened against most other currencies, driven by the rising expectations for forthcoming Fed rate cuts. The euro gained 0.16 percent, trading at $1.15295, while the British pound remained stable at $1.3098 ahead of Wednesday’s budget announcement.

In commodities, Brent crude futures fell by 0.5 percent to $62.27 per barrel, while spot gold prices remained steady at $4,064 per ounce.

As the week progresses, market participants will continue to monitor economic indicators and geopolitical developments closely, which could further shape investor sentiment and market performance.