All Australians could receive a rebate of $3,300 annually if a proposed increase in the Goods and Services Tax (GST) is implemented. This ambitious plan, which some advocates argue could enhance the national budget by $28 billion each year, aims to improve living standards across the country. The proposal was highlighted by independent Member of Parliament Kate Chaney, who supports a plan initially suggested by economist Richard Holden to raise the GST rate to 15 percent and broaden the tax to include essentials such as food, education, health care, and childcare services.

Under this proposal, the increased GST would generate an estimated $92.5 billion during its first full year. Importantly, the plan includes a rebate to every Australian adult over the age of 18, effectively mitigating the higher tax burden on the first $22,000 of individual purchases. This would result in low- and middle-income earners potentially being better off by up to $371 annually, while the wealthiest 20 percent would incur additional costs exceeding $2,200, leading to a cost of $68.8 billion for the government.

Chaney, who has collaborated with Holden on this concept for two years, emphasized that discussions at the upcoming economic roundtable must remain open to all tax reform options. “GST is an efficient tax – it is hard to avoid – and with lower- and middle-income groups potentially better off under this proposal, it can be progressive,” she stated. Holden, set to release a paper with economist Rosalind Dixon, noted that this change could particularly benefit younger Australians, who currently bear a disproportionate personal income tax burden.

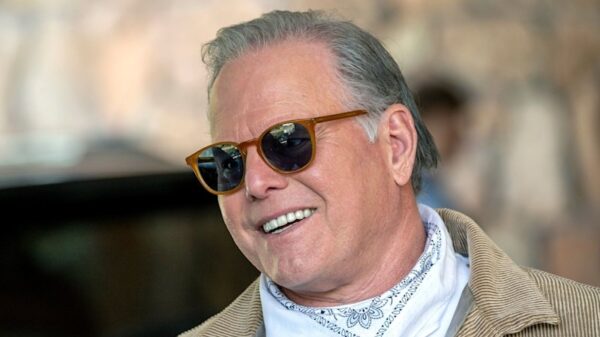

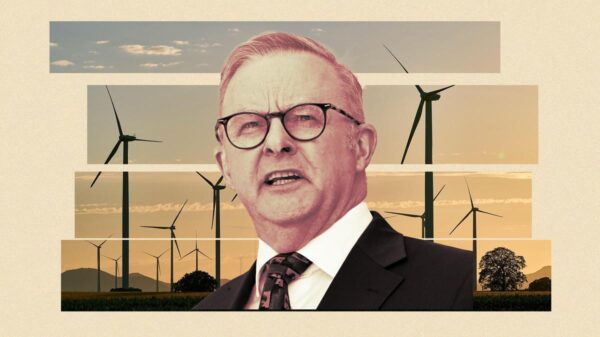

Despite the enthusiasm from some independents, the Australian government has shown reticence regarding GST changes. Prime Minister Anthony Albanese has indicated a lack of support for altering the GST framework, referencing an agreement made when the tax was first introduced by the Howard administration, which ensured that all revenue generated would go to the states and territories. Treasurer Jim Chalmers supported this position, stating that the government had not been actively seeking alternatives to that agreement.

Independent MP Allegra Spender, also advocating for tax reform and the only non-major party MP invited to the roundtable, has urged the government to address the financial sustainability of the National Disability Insurance Scheme (NDIS). Citing research from McKinsey and the e61 Institute, she warned that without adjustments to the current growth targets, the NDIS—a program currently costing around $50 billion—could risk losing public support.

Spender highlighted the importance of addressing inefficiencies within the non-market economy, which has seen minimal productivity growth over the past two decades. She anticipates that discussions regarding the care economy will be a focal point on the first day of the roundtable, particularly regarding how to enhance government service efficiency.

The independent Centre for Policy Development has submitted recommendations suggesting that any changes to the GST and other elements of the tax system should be considered. The think tank posits that increasing the GST rate and extending its coverage could significantly enhance productivity. It also advocates for indexing personal income tax thresholds to inflation and replacing state stamp duties with a land tax.

In a related note, the Centre for Independent Studies has issued a warning that without improvements in productivity, the living standards of Australians may continue to decline. Economist Jim Cox pointed out that Australian businesses are lagging in their adoption of new technologies compared to overseas competitors. He called for a renewed focus on micro-economic reform and smarter regulations to promote innovation.

Meanwhile, the Australian Council of Trade Unions (ACTU) is calling for the implementation of a national skills levy. This proposal would require medium to large employers, those with an annual turnover exceeding $500,000, to allocate 1.5 percent of their payroll towards employee training. If they fail to meet this commitment, they would be liable for a similar levy.

As the national conversation around tax reform continues, the implications of these proposals could significantly reshape the economic landscape in Australia, with potential impacts on living standards and public services.