Global stock markets are poised for their most significant weekly decline in seven months, driven by concerns over the sustainability of the recent rally in artificial intelligence (AI) stocks and disappointing trade data from China. As of early trading on Friday, the STOXX 600 index, which tracks 600 large European companies, fell by 0.17 percent. In contrast, US markets appeared to be on a more positive trajectory, with S&P 500 futures and Nasdaq 100 futures up 0.3 percent following a 1.9 percent drop for the Nasdaq on Thursday.

The downturn in AI stocks has been particularly notable, with the Nasdaq index down 2.8 percent for the week, marking its largest weekly drop since April when tariffs were first implemented. Since then, the Nasdaq has seen a remarkable increase of over 50 percent. The latest data from China revealed that the country’s exports shrank by 1.1 percent in October, the worst performance since February, heightening concerns about the impact of US tariffs on Chinese trade.

Decline in Asian Markets

The ripple effects of the Chinese trade data were felt across Asian markets, with both the CSI300 Index and the Shanghai Composite Index closing 0.3 percent lower on Friday. Japan’s Nikkei experienced a drop of 1.2 percent, leading to a weekly loss of 4.1 percent, its largest decline since April. Meanwhile, in South Korea, the KOSPI fell by 1.8 percent, resulting in a 3.7 percent weekly drop, the most significant since February.

The tech sector has particularly suffered, with companies such as Softbank Group Corp seeing a near 20 percent decline in stock value this week. Even Bitcoin, often viewed as a barometer for tech sentiment, dropped by 8 percent this week, trading at US$101,525 (A$156,600).

Despite the lack of a specific catalyst for the pullback in AI stocks, market reactions to recent earnings reports have raised concerns about potential overvaluation in the sector. Notably, Meta’s stock plunged after the company announced substantial capital expenditures related to its AI initiatives. Similarly, shares of Palantir Technologies faced a decline despite outperforming earnings forecasts.

Market Sentiment Shifts

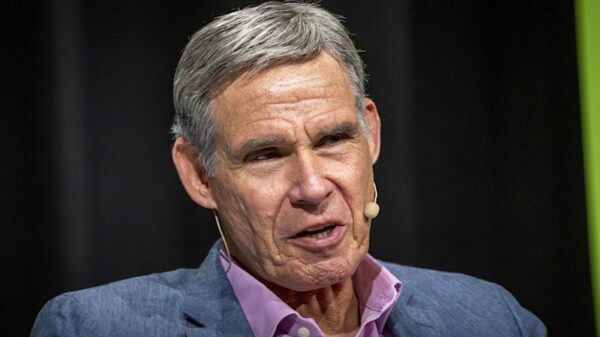

Herald van der Linde, head of equity strategy for Asia Pacific at HSBC, commented on the market’s changing sentiment. “Sometimes it’s a gradual shift in markets whereby an increasing number of people say: ‘Well, I’m well positioned … maybe I’ll take some money off the table,'” he explained. This sentiment shift can create a domino effect, where one investor’s decision to sell prompts others to follow suit.

In response to growing uncertainty, bond markets have rallied as investors sought safer assets. The 10-year US Treasury yields fell by 6.4 basis points to 4.09 percent on Thursday, prompted by a report from Challenger, Gray & Christmas indicating a surge in announced job cuts in October. On Friday, yields remained stable as traders continued to monitor these developments.

The dollar index, which measures the currency’s strength against a basket of six currencies, increased by 0.2 percent to 99.845, while the euro remained steady at US$1.1535 (A$1.78). The Japanese yen also showed signs of strength, poised for a modest weekly gain of about 0.3 percent, trading at 153.46 per dollar.

Gold prices remained elevated, trading above US$4,000 (A$6,170) per ounce as the ongoing US government shutdown intensified demand for safe-haven assets. Though prices were still below the record high of US$4,381.21 (A$6,759) reached on October 20, the current demand illustrates the market’s cautious stance.

Oil prices experienced a slight uptick following three consecutive days of declines, with Brent crude futures rising by 69 cents (1.09 percent) to reach US$64.05 (A$98.81) per barrel. Concerns about oversupply and slowing demand in the US continue to weigh on the market, contributing to the overall cautious sentiment.

As the week draws to a close, investors will be closely monitoring economic indicators and market trends to gauge the sustainability of the tech rally and the broader implications of trade developments.